Mt Bank Ach Transfer Fee What Is It And How Long Does It Take? 2023 47 Off

M&t bank can accept payments in the following formats: Learn how to add an external account to your m&t bank account. Ppd and ppd+ are accepted, however they should only be.

ACH Transfer What Is It And How Long Does It Take? (2023), 47 OFF

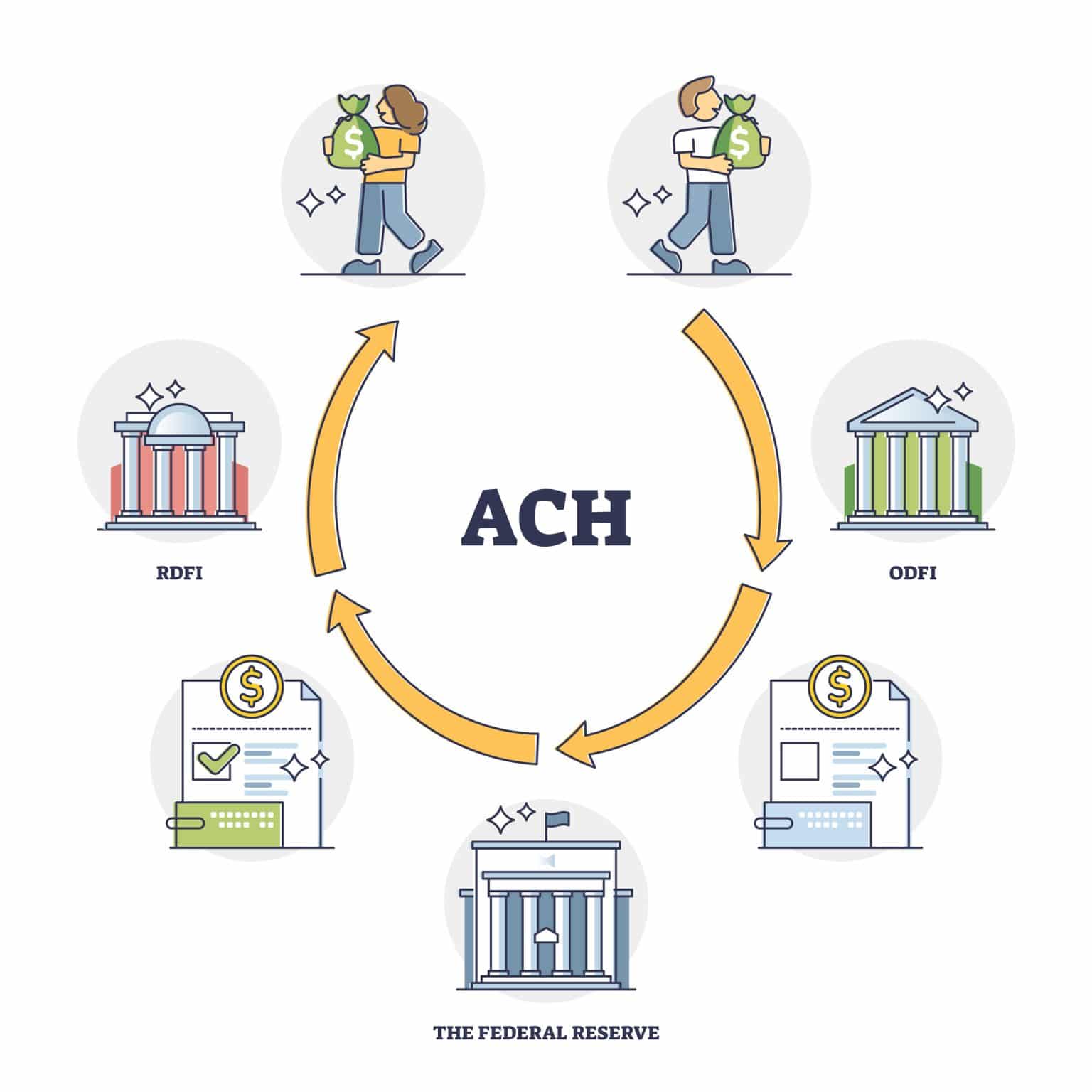

Ach transfers often come with lower fees, but the transfer may take a few days to process. Get set up to submit direct transmission ach files with m&t and use our ach monitor service to confirm the timing and accuracy of payments, enter required control totals, research ach. So, wire transfers are ideal for urgent transactions or international transfers that ach can't handle.

International and domestic wire transfer fees for m and t bank are as follows:

To begin, simply log in to m&t online banking and, under the payments and. Learn how you can manage and pay your business expenses through online banking for business using m&t bizpay. You get a great exchange rate and a low, upfront fee every time. Here is a general breakdown of the fees:

Endorse the check and etc like normal and it should be fine and. Whether it's swift codes, routing numbers, or wire transfer information, get everything you need to send and receive payments using m&t bank below. With rtol interbank transfer fees ranging from idr 6,500 to idr 7,500. Llg and skn are commonly used for transfers with larger amounts, with limits up to 500 million rupiah.

Mt Bank Ach Transfer Fee

The bank reserves the right to waive this fee in certain jurisdictions.

A recurring ach payment is an electronic payment that you setup using your debit card or routing and checking number to pay a specific amount on a set schedule, e.g. Learn more about how to send a bank wire through m&t or to enroll in any of our wire transfer services. Apart from the wire transfer fees, if the transfer involves currency conversion, banks make. Foreign currency transfer fee < $10,000 (business) $60.00 incoming international wire transfer fee (personal).

Generally, for most checking accounts, you can just write a check to cash and deposit it into your destination account. Ach is a network of banks that processes electronic fund transfers in batches that take anywhere from a few hours to several days to complete. But for this privilege, you'll pay a fee, typically ranging from $25 to $50. Ccd, ccd+, and ctx for corporate to corporate payments.

Mt Bank Ach Transfer Fee

The combined limit for inbound and outbound transfers is $2,000 per day and $5,000 within any 30 day period.

ACH vs Wire Transfer Which Method Should You Use?

ACH Transfer What Is It And How Long Does It Take? (2023), 47 OFF

How Long Do ACH Transfers Take to Process? Self. Credit Builder