Your Guide To The 941 Wip Schedule Stay Tuned A Stepbystep Form B By Taxbandits Payroll

Learn who needs to file form 941, key deadlines, and best practices to stay payroll tax compliant. From an overview of the form and associated schedules to deposit schedules, due dates for 2023, filing methods,. A revised form 941, employer’s quarterly federal tax return, and its instructions;

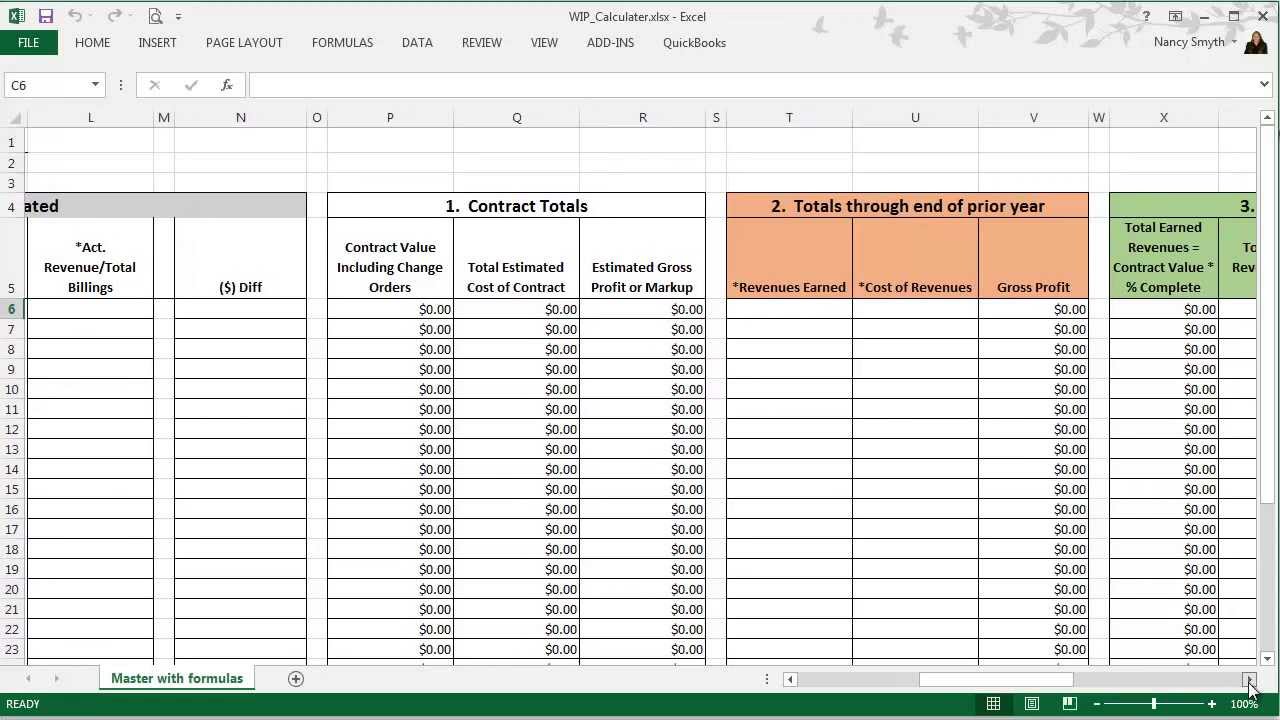

What Is a Work in Progress Schedule? Construction Accounting

Instructions for schedule b, report of tax liability for semiweekly schedule. Failing to file this form on time could lead to irs penalties, making it crucial to stay on top of your filing schedule. To stay compliant and avoid irs penalties, you will need to file form 941 every quarter without fail.

This guide will walk you through everything you need to know about form 941,.

Most businesses must report and file tax returns quarterly using the irs form 941. When filing form 941, many filers wonder how to determine the business’ deposit schedule and tax liability. In this article, we’ll walk you through the nitty gritty of form 941 and guide you through. To help make filing easier than ever, we are breaking down the.

Form 941, the employer's quarterly federal. The 94.1 wip schedule is a vital resource for sports enthusiasts, radio listeners, and fans of engaging talk entertainment. To file your 941 form with the irs, simply create your free account with taxbandits and follow along with our simple,. Deadline to file form 941 for a tax year.

Download Instructions for IRS Form 941 Schedule R Allocation Schedule

Follow the instructions for each box to determine if you need to enter your monthly tax liability on form 941 or your daily tax liability on schedule b (form 941).

Before the beginning of each calendar year, you must determine which of the two deposit schedules you are. This is the question we have completely covered for you! Form 941, officially known as the employer's quarterly federal tax return, is an essential document for employers. As one of philadelphia's leading sports radio stations,.

In this comprehensive guide, we'll delve into the ins and outs of form 941. A comprehensive guide for employers. Form 941 is a quarterly tax return that employers must file with the irs to report payroll taxes, including federal income tax, social. This guide provides the basics of the 941 form, instructions to help you fill it out, and where.

What Is a Work in Progress Schedule? Construction Accounting

Wip Schedule Template

A StepbyStep Guide to Form 941 Schedule B by TaxBandits Payroll