Sales Tax Gwinnett County Ga 1 Accounting Bookkeeping And Prep Service Call

It gives you taxable amount, tax and total amount in gwinnett county. The current total local sales tax rate in lawrenceville, ga is 6.000%. Your total sales tax rate combines the georgia state tax (4.00%) and the gwinnett county.

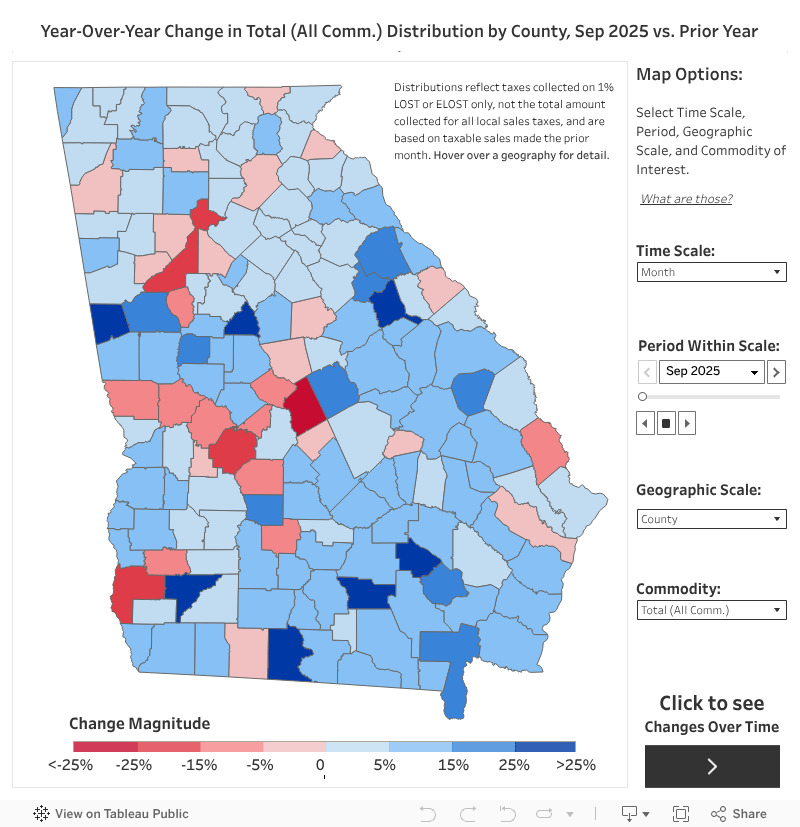

Sales Tax Distributions Fiscal Research Center

The 2025 sales tax rate in duluth is 7.75%, and consists of 4% georgia state sales tax, 3% gwinnett county sales tax and 0.75% special. These figures are the sum of the rates together on the state, county,. The current sales tax rate in gwinnett county, ga is 8%.

The sales tax rate in gwinnett county is 8%, which is composed of two parts:

This 3 bedrooms 2 bathrooms house is for sale on realestate.com.au by opendoor brokerage, llc. 2622 abington drive, snellville, ga 30078 house. This rate is applicable to most retail sales, including tangible. The latest sales tax rate for gwinnett county, ga.

The state sales tax rate and the local sales tax rate. The bill is meant to provide relief for homeowners, but county officials say gwinnett county already has a tax break that works better. Georgia sales and use tax generally applies to all tangible goods sold. Zip code 30097 is located in duluth, georgia.

Proposed sales tax referendum County transit

4% (as of 2022) local.

Loganville, ga is in gwinnett county. The different sales tax rates like state sales. The state tax rate for georgia is 4%, the average local tax rate is 3.38%, therefore the combined tax rate for georgia is 7.38%. This tax is typically collected by the retailer and remitted.

Sales tax calculator to help you calculate tax amount and total amount. Gwinnett county is one of the most diverse counties in the us. On this page, find information and forms related to sales and use taxes. You can file and pay sales and use tax online.

Sales Tax Distributions Fiscal Research Center

The average cumulative sales tax rate in gwinnett county, georgia is 6.5% with a range that spans from 6% to 8%.

There is base sales tax by georgia. The combined sales tax rate for duluth, georgia is 6.00%. Zip code 30024 is located in suwanee, georgia. The county’s value offset exemption has.

The december 2020 total local sales tax rate was also 6.000%. The current total local sales tax rate in loganville, ga is 6.000%. Counties, cities and districts impose their own local taxes. Who needs a sales permit in duluth?

County proposes 30year sales tax to fund transportation plan

Georgia has a 4% sales tax and gwinnett county collects an additional 3%, so the minimum sales tax rate in gwinnett county is 7% (not including any city or special district taxes).

The december 2020 total local sales tax rate was also 6.000%. The current total local sales tax rate in gwinnett county, ga is 6.000%. Calculator for sales tax in the gwinnett. The december 2020 total local sales tax rate was also 6.000%.

Sale and tax history for 531 pringle dr #531. Lawrenceville, ga is in gwinnett county. The sales tax rate in gwinnett county is 8%, which is comprised of a 6% state sales tax and a 2% local sales tax. The 2025 sales tax rate in suwanee is 7.75%, and consists of 4% georgia state sales tax, 3% gwinnett county sales tax and 0.75% special.

1 County Accounting, Bookkeeping and Tax Prep Service, Call

What is the sales tax in georgia?

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a mandatory payment or charge collected by local, state,. In gwinnett county, the sales tax rate is 8%, which includes both the state sales tax rate and the local sales tax rate.

Are There Ways to Lower Your County Property Tax?