Wa King County Sales Tax Rate Mark Martinez' Blog Yeah We Still Redistribute Wealth Big Time

The current total local sales tax rate in king county, wa is 10.100%. The average cumulative sales tax rate in king county, washington is 10.12% with a range that spans from 8.8% to 10.5%. The proposal would increase the average king county homeowner’s property tax by an estimated $3.44 per month to a total of $17.18, king county executive dow constantine’s.

King County Sales Tax King County, Washington

The sales tax rate in king county includes the washington state tax and the district’s. The rate can range from 7.0% to 10.4%, depending on. Overall property taxes for the 2025 tax year are $7.7 billion, an increase of approximately $121 million or 1.6% from the previous year of $7.6 billion.

You can use our washington sales tax calculator to look up sales tax rates in washington by address / zip code.

The washington sales tax rate is currently 6.5%. This is the total of state, county, and city sales tax rates. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including any city or special district taxes). Click any locality for a full breakdown of local property.

Local sales and use tax rates by city/county tax rates effective oct. The latest sales tax rate for king county, wa. (9.46 percent), washington (9.43 percent), and alabama. For footnote information, please see the bottom of page 5.

King County Sales Tax King County, Washington

Use this search tool to look up sales tax rates for any location in washington.

Washington has 726 cities, counties, and special districts that collect a local sales tax in addition to the washington state sales tax. The different sales tax rates like state sales tax, county tax rate and city tax rate in king county are 6.50%, 2.10% and 3.46%. Check sales tax rates by cities in king county The calculator will show you the total sales tax amount, as well as the.

The current sales tax rate in king county, wa is 10.5%. The minimum combined 2025 sales tax rate for king county, washington is 8.8%. The king county, washington sales tax is 10.00%, consisting of 6.50% washington state sales tax and 3.50% king county local sales taxes.the local sales tax consists of a 3.50% special. The december 2020 total local sales tax rate was 10.000%.

King County Sales Tax King County, Washington

Compare 2025 sales tax rates by state across the us with our state and local sales tax map.

To calculate sales and use tax only. Sales and use tax rates effective july 1, 2024 listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: King county, located in central western washington, has sales tax rates ranging from 8.80% to 10.50%. Explore 2025 sales taxes by state!

Major cities within king county, including seattle, bellevue, and. These figures are the sum of the rates together on the state,. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Washington state sales tax is determined by the combined state base rate and local rates, which vary by county and city.

King County Revenues King County, Washington

King county’s combined sales tax rate for 2023 stands at 10.1%, consisting of a 6.5% state base rate and 3.6% in local taxes;

You’ll find rates for sales and use tax, motor vehicle taxes, and lodging tax. Tax rates are updated quarterly. 535 rows washington has state sales tax of 6.5%, and allows local governments to collect a.

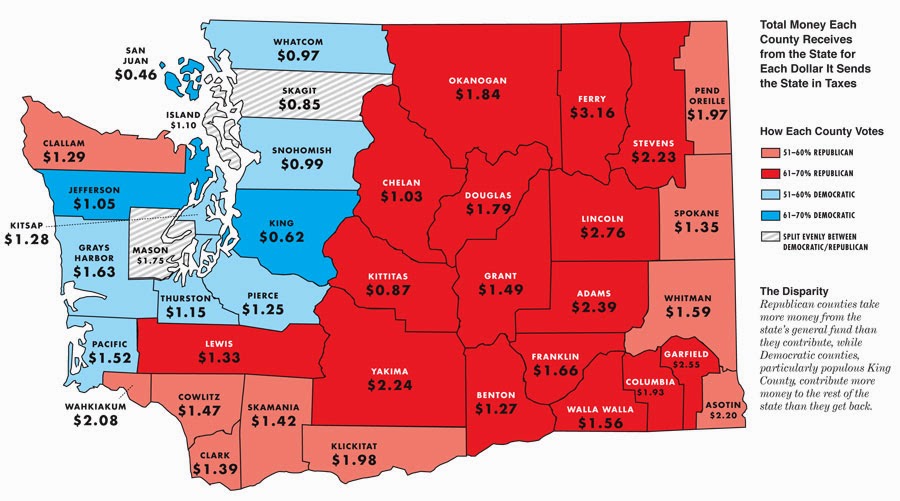

MARK MARTINEZ' BLOG YEAH, WE STILL REDISTRIBUTE WEALTH BIG TIME

King County Rta Tax Map